Paul B Insurance Insurance Agent For Medicare Huntington Things To Know Before You Get This

5 Stars in Washington, and also 4 Stars in Stars in Oregon as well as Southwest Washington. [See afterthought 4]. Get a lot more information Read more about celebrity quality scores or enjoy our video "Medicare Celebrity Top Quality Ratings" for more information concerning why they matter when selecting a Medicare health plan. Discover more regarding Medicare.

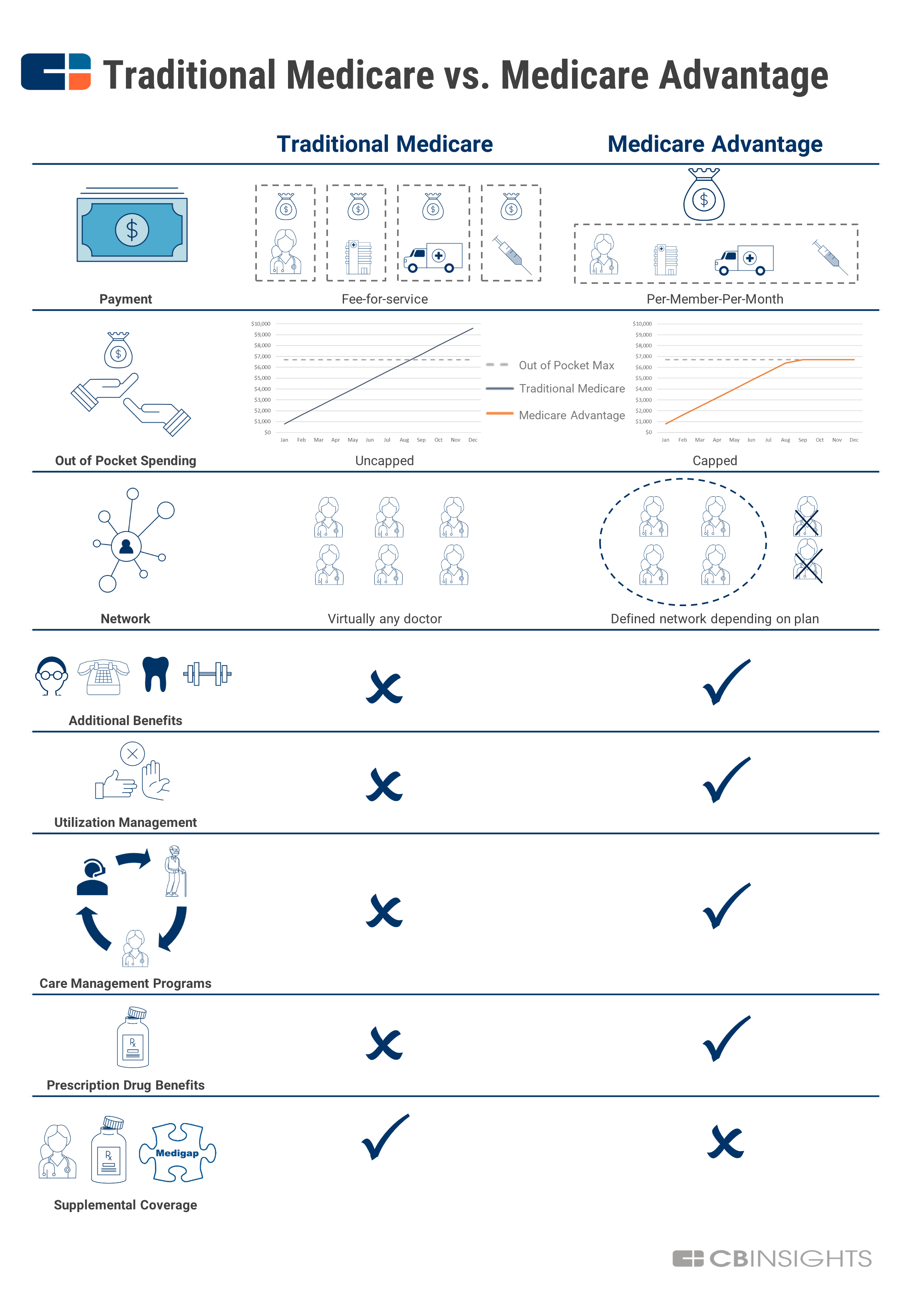

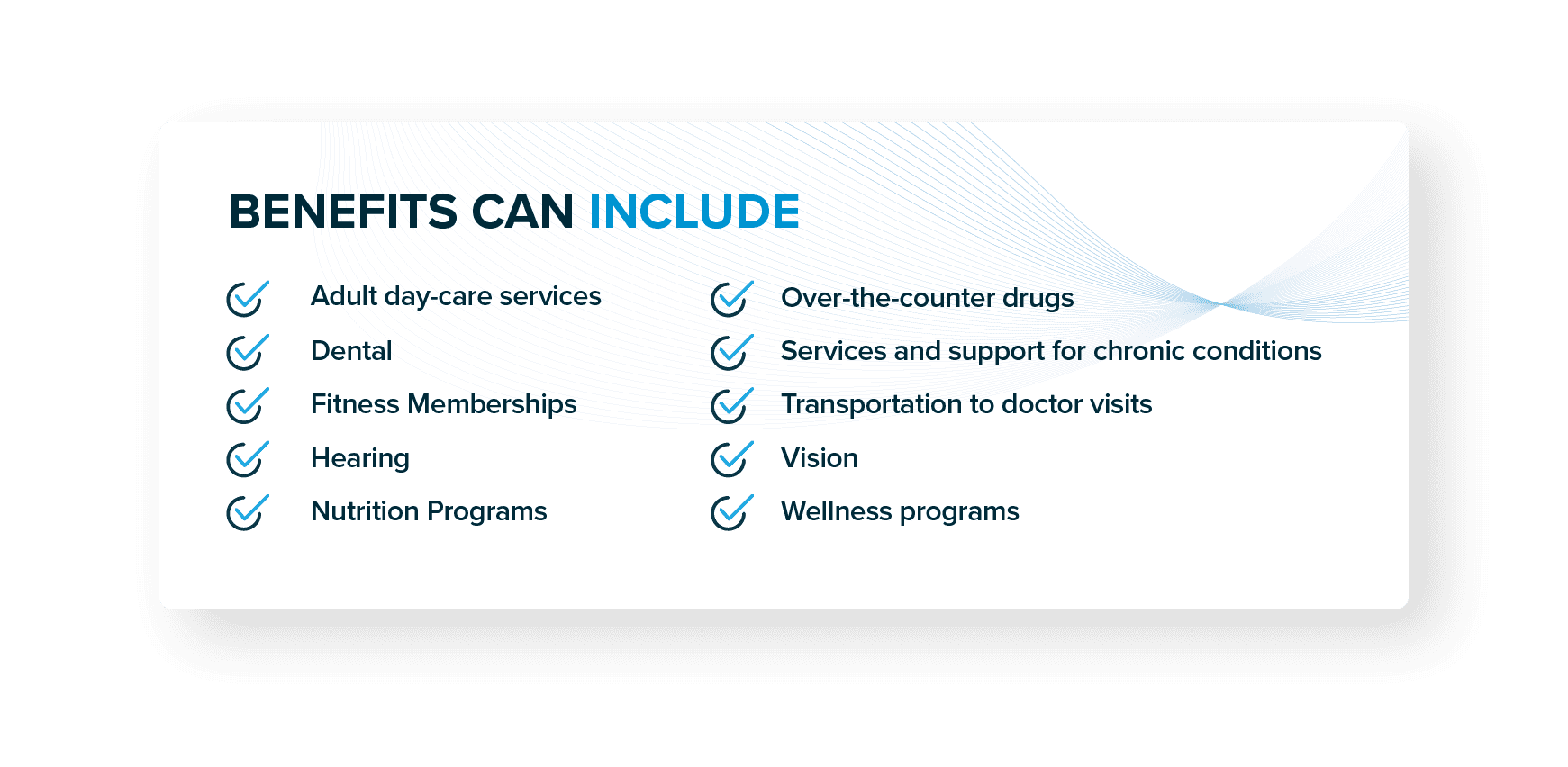

Medicare Advantage (Part C) plans are exclusive insurance plans. These plans incorporate several elements of Medicare, like components An and also B, with other services, such as prescription, dental, and vision insurance coverage.

Various strategies can pick which medications they list in their medicine listings or formularies. Many prescription drug plans group covered medicines by: formulary, which is a list of prescription medicines covered in the plan usually with at the very least two options for each medication class or categorygeneric drugs that may be alternatived to brand-name medications with the same effecttiered programs that provide various degrees of drugs (common just, common plus name brand, and so on) for a variety of copayments that raise with your medication prices, The price of Medicare Part D prepares depends on which prepare you choose and what drugs you need.

Little Known Facts About Paul B Insurance Medicare Advantage Agent Huntington.

Medigap plans may not cover all out-of-pocket costs, but you however find the one that best suits ideal financial and economic and alsoWellness Right here's an overview of what each of the 10 Medigap strategies cover: * After January 1, 2020, people that are new to Medicare can not make use of Medigap plans to pay the Medicare Component B insurance deductible.

It can take some time as well as initiative to sift through the lots of kinds of Medicare plans. These choices offer you a lot more selections when it comes to coverage and the expense of your healthcare. When you're very first eligible for Medicare, be certain to evaluate all its parts to find the most effective suitable for you and also avoid charges later.

How Paul B Insurance Insurance Agent For Medicare Huntington can Save You Time, Stress, and Money.

The information on this site may aid you in making personal decisions about insurance coverage, however it is not meant to offer advice pertaining to the acquisition or usage of any insurance coverage or insurance coverage products. Healthline Media does not negotiate the company of insurance policy in any kind of manner and also is not licensed as an insurance firm or producer in any type of U.S.

Healthline Media does not suggest or endorse any kind of 3rd parties that might transact business of insurance policy.

Most Medicare Advantage plans additionally offer prescription medicine coverage. In comparison to Original Medicare, there are many benefits as well as benefits when picking a Medicare Benefit plan. When selecting your Medicare insurance coverage, you may pick Original Medicare or Medicare Advantage, likewise called Medicare Component C. Medicare Advantage prepares cover all the solutions that Original Medicare covers besides hospice treatment.

Regular monthly costs, annual deductibles, and also copays may be included in your Medicare Advantage plan expenses. Some strategies might bill a pair hundred bucks for costs and deductibles and other plans might not charge you anything.

Paul B Insurance Medicare Supplement Agent Huntington Fundamentals Explained

For lots of Americans who use Medicare coverage, Medicare Advantage strategies are a great selection. Learn more concerning the concerns you need to be asking to help you find the very best Medicare protection for you. There are numerous factors to take into consideration when choosing a Medicare Benefit plan or Initial Medicare. Prior to selecting which strategy to choose, it is essential to take a look at all your alternatives as well as consider in prices and advantages to make a decision on the protection that works ideal for you.

Prior to you enlist in a Medicare Advantage prepare it is necessary to recognize the following: Do all of your service providers (medical professionals, medical facilities, and so on) accept the plan? You have to have both Medicare Parts An and also B as well as stay in the index service area for the strategy. You should remain in the plan up until completion of the fiscal year (there are a couple of exceptions to this).

Recap: If you have Medicare Component A and Component B, you may have the choice to enlist in a Medicare Benefit plan. Medicare Benefit (Medicare Component C) is an alternative method to receive your Medicare Part An and also Part B insurance coverage. It does not change your Medicare Part An as well as Component B insurance coverage.

These strategies are readily available from private, Medicare-approved insurance coverage firms, and also they're permitted to use advice extra benefits beyond Part An and also Component B. Some strategies consist of prescription medicine coverage, as an example. Strategies might include routine for dental and vision treatment as well as other health-related services not covered by Original Medicare (Component An and also Component B).

Not known Facts About Paul B Insurance Medicare Supplement Agent Huntington

Medical Cost Savings Accounts (MSA)A Medicare MSA strategy is similar to a Wellness Savings Account (HSA), which you might recognize with from your years of employment. MSAs have 2 components: a high deductible insurance plan and also a special savings account. The Medicare Advantage plan transfers a sum of Medicare cash right into the MSA that pays some, however not all, of the plan's insurance deductible.

Please call the strategy's customer solution number or see your Evidence of Coverage to learn more, consisting of the expense sharing that uses to out-of-network services (paul b insurance Medicare Supplement Agent huntington).

There are 4 components of Medicare: Component A, Part B, Part C, and Part D. In general, the 4 Medicare components cover various solutions, so it's vital that you comprehend the Homepage choices so you can choose your Medicare insurance coverage carefully.

There are four components to Medicare: A, B, C, and also D - paul b insurance medicare advantage plans huntington.Part A is automatic and consists of repayments for treatment in a medical center. Part B is automatic if you do not have various other health care protection, such as through a company or partner. Component C, called Medicare Benefit, is a private-sector alternative to traditional Medicare.

Facts About Paul B Insurance Medicare Advantage Plans Huntington Uncovered

Medicare has actually developed throughout the years and also currently has four parts. While some are compulsory, others are optional.